south carolina inheritance tax rate

What tax rate is paid by an estate or trust. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits.

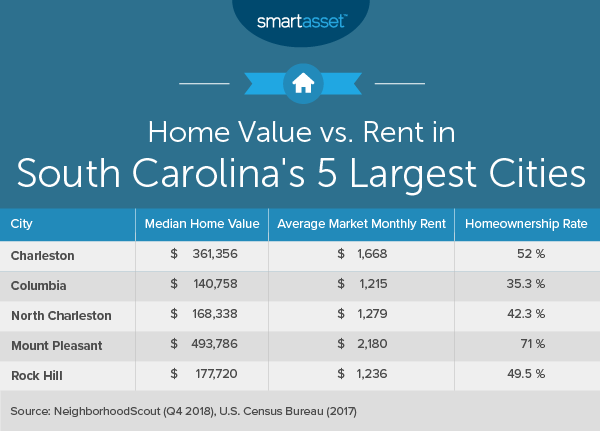

South Carolina Estate Tax Everything You Need To Know Smartasset

There are no inheritance or estate taxes in South Carolina.

. Aiken South Carolinas incredible cost of living is another key factor to consider when determining your retirement destination. Notice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. Surviving spouses are always exempt.

Individual income tax rates range from 0 to a top rate of 7 on taxable income. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000 of unused. 4 The federal government does not impose an inheritance tax.

Detailed South Carolina state income tax rates and brackets are available on this page. There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it. Ad Get free estate planning strategies.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Dont leave your 500K legacy to the government. State Inheritance Taxes.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. South Carolina offers tax deductions and credits to reduce your tax liability including a. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. South Carolina taxes gains on investments held for longer than one year at a rate shown in the tables above. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax.

Tax brackets are adjusted annually for. An electing small business trust is taxed at 7. Individuals should also know about the federal estate tax.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. You pay inheritance tax as part of your. The state income tax rates range from 0 to 7 and the sales tax rate is 6.

117 million increasing to 1206 million for deaths that occur in 2022. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. Localities can add as much as 3 and the average combined rate is 744 according to the Tax Foundation.

There is no federal inheritance tax but there is a federal estate tax. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Any other estate or trust pays the same rate that applies to individuals.

However these gains currently have a 44 exemption. Your federal taxable income is the starting point in determining your state income tax liability. State inheritance tax rates range from 1 up to 16.

On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. South Carolina does not have an estate or inheritance tax.

South Carolina does not assess an inheritance tax nor does it impose a gift tax. However the federal government still collects these taxes and you must pay them if you are liable. If an estate is valued over a certain amount 1158 million in 2020 the estate is subject to an estate tax.

South Carolina Sales Tax. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance tax. A federal estate tax is in effect as of 2021 but the exemption is significant.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption. South carolina inheritance tax rate Sunday June 19 2022 Edit.

In 2020 rates started at 10 percent while the lowest rate in 2021. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

States Without Death Taxes. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Get Access to the Largest Online Library of Legal Forms for Any State.

Estate is more than 1206 million in 2022. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

A Guide To South Carolina Inheritance Laws

South Carolina State 2022 Taxes Forbes Advisor

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Cost Of Living In South Carolina Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset

Are There Any States With No Property Tax In 2022

A Guide To South Carolina Inheritance Laws

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

South Carolina Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

South Carolina Estate Tax Everything You Need To Know Smartasset

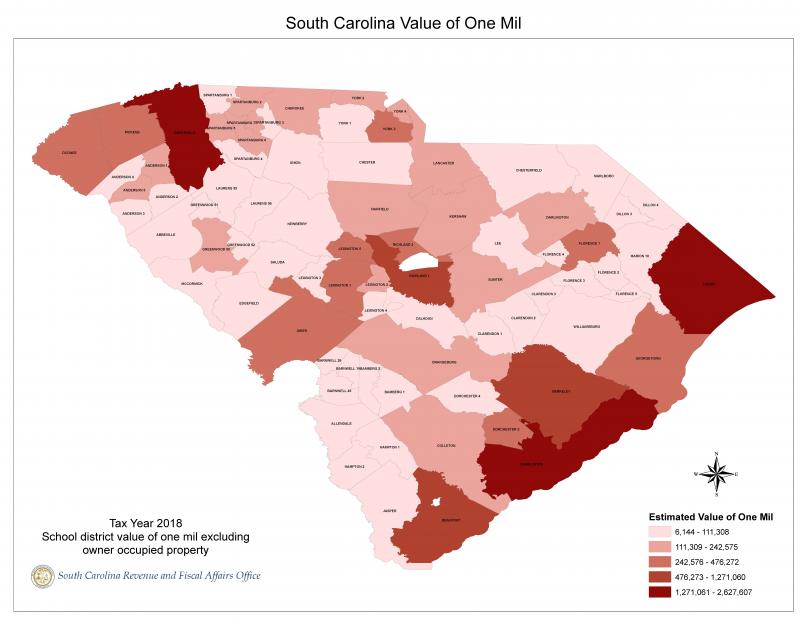

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

South Carolina Lawmakers Reach Deal To Cut Income Tax

South Carolina Retirement Tax Friendliness Smartasset

Real Estate Property Tax Data Charleston County Economic Development

Boo St Clair County Real Estate Taxes 892 Historic Homes Historic Homes For Sale Old House Dreams